Lebanon

18 WOODS DR

Property Information

- Site

- Map R01, Lot 016, Sub A002

- Town

- Lebanon

- Tax Year

- 2024

- Owner

- WOZMAK, ALBERT

- Last Committed Tax

- $3,208.79

- Land Value

- $135,500

- Building Value

- $227,267

- Total Real Value

- $362,767

- Exemption Value

- $25,000

- Net Taxable Real Value

- $337,767

Owner Information

- Owner #1

- WOZMAK, ALBERT

- Owner #2

- WOZMAK, REBECCA J

- Mailing Address

- PO BOX 343

LEBANON, ME 04027 - Trio Account #

- 23

- Book

- 3898

- Page

- 62

- Purchase Price

- $0

Documents:

Land Information

| Land Group: Type | Size | Value |

|---|---|---|

| Primary Lot: Table 4 | 2 AC | $69,000 |

| Primary Lot: Additional 4 | 18 AC | $36,500 |

| 20.00 Ac | $105,500 |

Site Improvement

Improvements made to the property such as a well, septic system or driveway.

| Description | SI Value |

|---|---|

| Grade 3 | $30,000 |

| $30,000 |

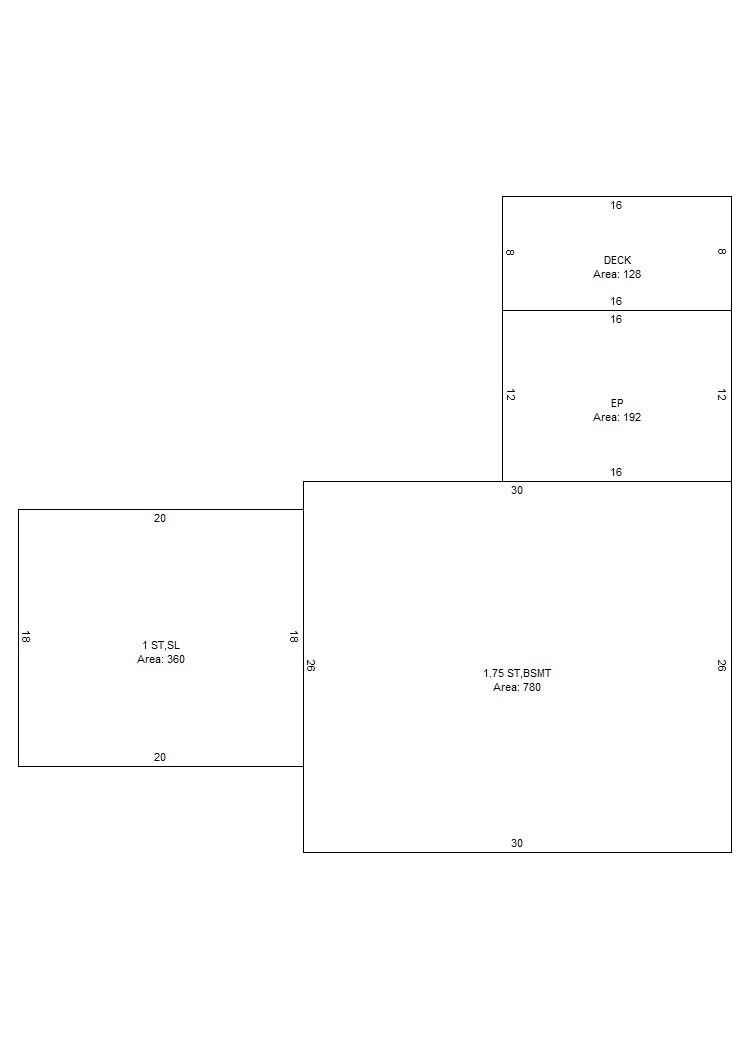

Building Data

| Building Type | Area | Grade | Cond | F.Obs. | E.Obs. | Value | Color | Year |

|---|---|---|---|---|---|---|---|---|

| 1¾-Story Frame | 780 | 4.25 | 85% | 100% | 100% | $164,701 | BRN | |

| 1-Story | 360 | 4.25 | 85% | 100% | 100% | $29,597 | ||

| Enclosed Porch | 192 | 4.25 | 85% | 100% | 100% | $9,837 | ||

| Deck | 128 | 4.25 | 85% | 100% | 100% | $2,546 | ||

| Garage | 480 | 4.25 | 85% | 100% | 100% | $20,586 |

Visit History

| Date | Purpose | Result | Individual |

|---|---|---|---|

| 07/12/2018 | Equalization | Measure | Dan Kane |

Exemptions

| Type | Value |

|---|---|

| Homestead | $25,000 |

Town Information

- Tax Rate

- 0.009500

- Tax Due Dates

- 11/07/2024

04/24/2025 - Commitment Date

- 09/23/2024

- Certified Ratio

- 1.00

- Address

- 15 Upper Guinea Road

Lebanon, ME 04027 - Phone

- 207-457-6082

- Fax

- 207-457-6067

- Tax Collector

- Christine Torno

- Treasurer

- Leslie Randazzo

Tax Maps

For Download

- Lebanon 2024 Cover

- Lebanon 2024 Index

- Lebanon 2024 Overall

- Lebanon 2024 R01

- Lebanon 2024 R02

- Lebanon 2024 R03

- Lebanon 2024 R04

- Lebanon 2024 R05

- Lebanon 2024 R06

- Lebanon 2024 R07

- Lebanon 2024 R08

- Lebanon 2024 R09

- Lebanon 2024 R10

- Lebanon 2024 R11

- Lebanon 2024 R12

- Lebanon 2024 R13

- Lebanon 2024 R14

- Lebanon 2024 R15

- Lebanon 2024 R16

- Lebanon 2024 R17

- Lebanon 2024 T01

- Lebanon 2024 T02

- Lebanon 2024 T04,5

- Lebanon 2024 T06

- Lebanon 2024 T07

- Lebanon 2024 U01

- Lebanon 2024 U02

- Lebanon 2024 U03

- Lebanon 2024 U04

- Lebanon 2024 U05

- Lebanon 2024 U06

- Lebanon 2024 U07

- Lebanon 2024 U08

- Lebanon 2024 U09

- Lebanon 2024 U10

- Lebanon 2024 U11

- Lebanon 2024 U12

- Lebanon 2024 U13

- Lebanon 2024 U15

- Lebanon 2024 U16

- Lebanon 2024 U16A

- Lebanon 2024 U17

- Lebanon 2024 U18

- Lebanon 2024 U19

- Lebanon 2024 U20

- Lebanon 2024 U21

- Lebanon 2024 U22